MDB climate finance in 2024: what does the latest data tell us?

Multilateral development banks collectively claim $437 billion in climate finance investments between 2021 and 2024. But $71 billion remains untraceable to projects. In this blog, Ella Remande-Guyard explains why this transparency shortfall matters, and how our updated MDB climate finance dataset can help to understand exactly where climate finance is being directed.

Why project-level climate finance transparency still matters

Multilateral development banks (MDBs) report $437 billion in climate finance commitments between 2021 and 2024 through their annual Joint Reports. However, these headline figures only form part of the story. Detailed project-level disclosure is essential to verify where climate finance is going, assess which countries, sectors, and activities are being supported, and hold institutions accountable for how climate finance commitments are delivered in practice.

MDBs have committed to improving access to climate finance data, stating that “starting in the fourth quarter of 2025, detailed data will be available through an interactive web platform, giving stakeholders real-time access to climate finance information and enabling them to track MDBs’ collective progress towards their climate finance goals.” However, as of January 2026, this platform has not yet been released.

To highlight what is publicly disclosed (and what is not), we created the MDB Climate Finance Dataset in November last year – the first attempt to compile all publicly available, project-level climate finance data across 11 MDBs in one place. Today, we are releasing an updated version of the dataset, incorporating 2024 data. This blog sets out what has improved and what gaps remain.

What’s new in the 2024 update?

With the addition of 2024 data, the new dataset now covers four years of MDB climate finance (2021-2024). Across this period, we have identified:

- Around 6,500 unique climate finance investments

- $366 billion in climate finance commitments linked to individual projects

This means that $71 billion in reported MDB climate finance remains untraceable at the project level across the 2021-2024 period. For the year 2024, we were unable to identify $26 billion of climate finance investments of the $137 billion reported.

Has anything improved since 2023?

There have been incremental improvements in MDB climate finance disclosure in 2024, particularly in the formats used to publish data. The European Investment Bank (EIB) and the European Bank for Reconstruction and Development (EBRD) now publish bulk download files for their more recent climate finance data, which marks an improvement on earlier years where data was available only in PDFs. EBRD also started consistently disclosing project IDs in 2024, which previously were not disclosed for all projects. Making data available through bulk download is critical because it allows users to systematically analyse and compare information at scale, rather than relying on manual extraction from static documents.

For 2024 data, the African Development Bank (AfDB) made an important first step in disclosing project-level climate finance information at the individual project webpage level through its MapAfrica platform. However, this information must be extracted manually from individual webpages, making it difficult to use at scale. In addition, based on a review of recent projects, this disclosure does not appear to extend to projects approved in 2025 or 2026. There are also issues with the clarity and internal consistency of climate finance figures on some project pages, which makes it difficult to interpret and verify the amounts reported (see updated methodology note). To improve accessibility and consistency, AfDB should publish a comprehensive, up-to-date bulk dataset of its climate finance investments.

Where do the biggest gaps remain?

Despite these improvements, major transparency gaps persist.

Some MDBs still disclose no project-level climate finance data

The institutions that remain entirely absent from the dataset are the Council of Europe Development Bank (CEB), IDB Invest, the International Finance Corporation (IFC), the Multilateral Investment Guarantee Agency (MIGA), the Islamic Development Bank (IsDB), and the New Development Bank (NDB). Together, these institutions report billions in climate finance each year, yet none publish a list of climate-tagged projects that allow those figures to be independently verified.

Data locked in inaccessible formats

Other institutions continue to publish climate finance data in formats that limit accessibility. For example, the World Bank (International Bank for Reconstruction and Development and the International Development Association (IBRD and IDA)) and, for some Asian Infrastructure Investment Bank (AIIB) projects, climate finance information is disclosed in PDF format. These institutions could improve usability by adopting the bulk-download approaches already used by the Inter-American Development Bank (IDB), the Asian Development Bank (AsDB), EBRD and EIB. AIIB should disclose climate finance commitments, not only projects that have begun disbursing, in its bulk download file.

Crucial fields are still missing

Across many MDBs, key information is absent or inconsistent, including project IDs, sector classifications, project URLs, clear mitigation or adaptation splits, and commitment dates. These gaps significantly limit the usability of the data, even where projects are disclosed. For further detail on disclosure gaps see the ‘Source Dataset’ tab of the MDB Climate Finance Dataset.

How does transparency compare across years?

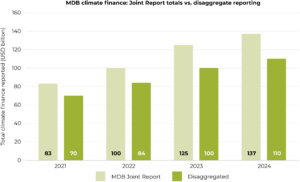

Although MDBs report steadily rising climate finance totals, this chart shows that the gap between Joint Report figures and disaggregate data persists across all years.

In both 2021 and 2022, 85 percent of the climate finance reported in the MDB Joint Reports could be linked to disaggregate data. This fell to about 80 percent in 2023, as total climate finance increased from $100 billion to $125 billion but project-level disclosure did not increase at the same rate. In other words, a larger share of newly reported climate finance in 2023 could not be traced back to individual projects, driven primarily by widening gaps at a small number of larger MDBs, most notably the World Bank Group (WBG), AfDB, AIIB and IsDB.

In both 2021 and 2022, 85 percent of the climate finance reported in the MDB Joint Reports could be linked to disaggregate data. This fell to about 80 percent in 2023, as total climate finance increased from $100 billion to $125 billion but project-level disclosure did not increase at the same rate. In other words, a larger share of newly reported climate finance in 2023 could not be traced back to individual projects, driven primarily by widening gaps at a small number of larger MDBs, most notably the World Bank Group (WBG), AfDB, AIIB and IsDB.

As shown in Behind the Billions, project-level data for IBRD and IDA aligns closely with Joint Report figures, indicating that the widening WBG gap across all years is driven by growth in IFC and the Multilateral Investment Guarantee Agency (MIGA) Joint Report claims, for which no project-level data are published. In parallel, between 2022 and 2023, AfDB and IsDB increased reported climate finance without corresponding investment-level disclosure, while AIIB’s disaggregate total declined due to timing differences between commitments and project-level reporting.

In 2024, 81 percent of climate finance reported in the MDB Joint Report could be identified in disaggregate data, a similar share to 2023. However, this similar figure masks important shifts across individual MDBs. The gap narrowed in 2024 for AfDB following the publication of disaggregate data, while NDB and IDB reported lower climate finance Joint Report totals in 2024 than in 2023. These changes were offset by continued increases in ‘unidentifiable’ climate finance at WBG (driven by IFC and MIGA growth), AIIB, and several other MDBs. As a result, offsetting changes across institutions explain why the overall coverage percentage remained largely unchanged in 2024.

Building a public benchmark for MDB climate finance disclosure

Taken together, this body of work demonstrates that while there is growing recognition of the importance of climate finance transparency, there is still no central, publicly available repository of investment-level MDB climate finance data. Our dataset is a start in filling this gap. It begins to show what can be done and what should be done, while also highlighting the gaps that remain. It serves both as a practical tool for users and as an initial benchmark for MDBs, illustrating examples of good practice and areas where disclosure is still insufficient.

Links

- Explore the updated MDB Climate Finance Dataset (2021-2024)

- Read the updated methodology note for full details on sources, coverage and limitations

- Read Behind the Billions for a detailed analysis of the 2021-2023 data