DFI Climate Finance Transparency: Concerning gaps but glimmers of hope

In this update, Ryan Anderton highlights the changing landscape of DFI climate finance, shares insights from the 2025 DFI Transparency Index, and outlines his hopes for future progress.

Two major shifts have reshaped the landscape since our 2024 examination of development finance institution (DFI) climate finance. First, official development assistance (ODA) fell for the first time in seven years, declining by around 7% last year, making DFIs increasingly central to achieving global development and climate targets. Second, in late 2024, a new global climate finance goal of US$300 billion annually was agreed, replacing the previous US$100 billion target.

Much of the climate finance funding to low- and middle-income countries (LMICs) is either delivered by DFIs or mobilised through them. The latest OECD DAC figures for 2022, show that multilateral development banks (MDBs) alone contributed almost 50% of the finance (around 40% directly and 9% via private sector mobilisation). Looking ahead, DFIs are expected to play an even greater role. A joint COP29 statement by ten MDBs set a collective target of US$120 billion annually in climate finance to LMICs by 2030, plus an additional US$65 billion mobilised from the private sector.

These commitments emphasise the critical importance of transparency in the way DFIs track and report climate finance. Without transparency, it’s hard to know whether the vast sums of money are really reaching where it’s most needed and achieving what DFIs set out to do. The major challenge right now is that most DFIs do not publish data that is detailed or disaggregated enough, leaving big gaps that make it difficult to follow the money or assess whether the figures they report reflect real impact.

The 2025 DFI Transparency Index: Advancing climate finance disclosure

To highlight transparency gaps and drive improvements, Publish What You Fund launched the 2025 DFI Transparency Index in July. It was the second assessment of leading DFIs, ranking 32 DFI portfolios based on 48 indicators. For the first time, the Index included indicators specifically assessing climate finance transparency.

Our approach to developing these new indicators combined rigorous analysis with extensive stakeholder engagement. We conducted interviews, consulted on proposed indicators, and incorporated feedback from civil society and technical experts. The resulting climate finance indicators are designed to respond directly to stakeholder information needs, helping to make DFI reporting more transparent, accountable, and useful. Importantly, the Index does not only assess whether data is disclosed, but also how it is presented, with higher scores for information that is available in accessible, bulk download formats that enable easy comparison, aggregation, and analysis.

Climate finance indicators: what we measured

The 2025 DFI Transparency Index includes indicators covering both organisational and project-level disclosure:

- Climate finance methodology (Indicator 36): Does the DFI publish its approach for defining and calculating climate finance?

- Project-level climate finance disclosure (Indicator 44): Are individual investments labelled as having climate finance, with amounts, mitigation/adaptation breakdowns, and a clear rationale for why it has been counted? Are sub-component or activity-level budget breakdowns provided?

These indicators are a crucial foundation for transparency and accountability. A transparent methodology allows verification and replication, while project-level disclosure enables stakeholders to assess alignment with global targets, evaluate effectiveness, and understand impact. Disaggregating finance by mitigation and adaptation supports monitoring against commitments like the US$300 billion annual goal. Detailed budget breakdowns and clear rationales ensure accountability and provide valuable insights for learning what works and why.

2025 findings: progress and gaps

The results show mixed progress:

- The majority of DFIs provide their general approach for defining and calculating climate finance.

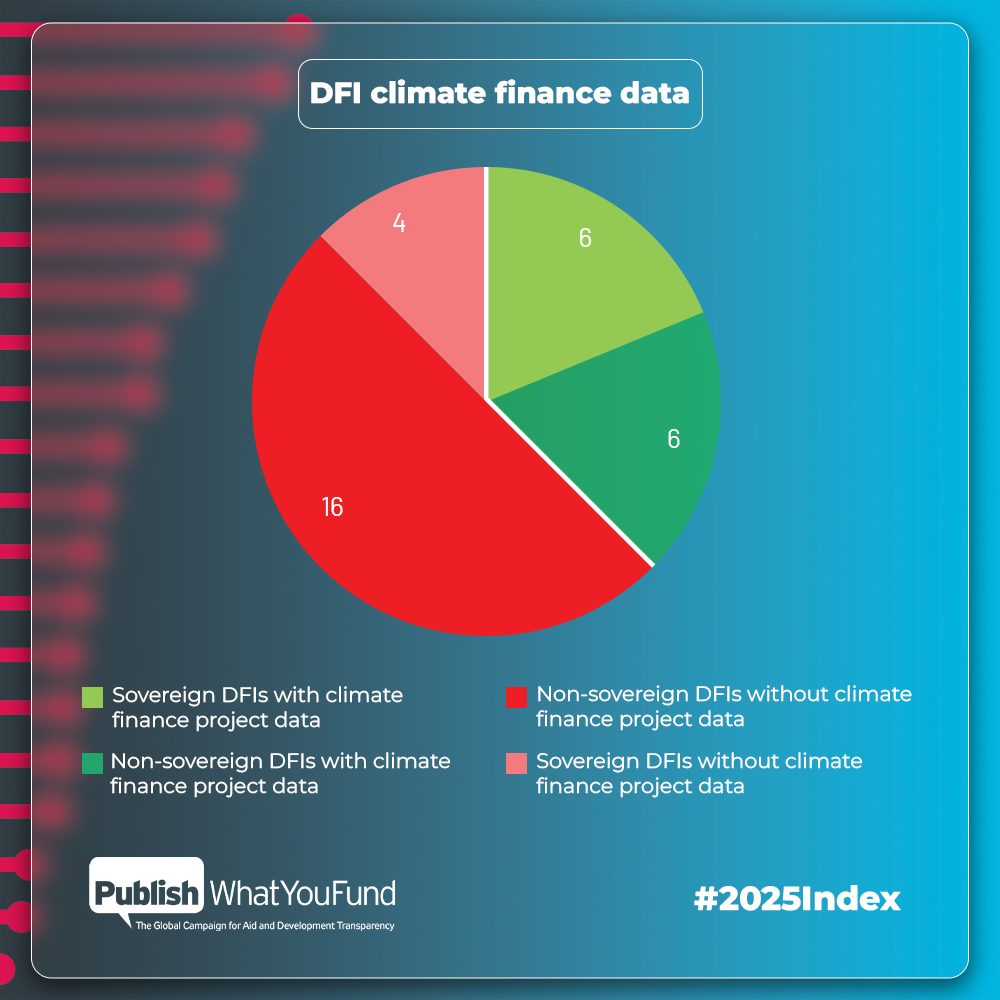

- Project-level data remains limited: 16 of 22 non-sovereign DFIs and 4 of 10 sovereign DFIs do not disclose any project-level climate finance information, making it impossible to determine which investments count as climate finance.

- Many DFIs fail to provide rationales or detailed budget breakdowns, limiting stakeholders’ ability to evaluate how and why finance is classified as climate related.

Overall, this concerning gap in disaggregated, detailed disclosure limits the ability to track climate finance, assess impact, and learn from investments.

It is important to note that our work and advocacy over the past year have already contributed to progress. The African Development Bank, Norfund (Norway), and OeEB (Austria) have begun disclosing climate finance project information, while British International Investment (BII – UK) and Proparco (France) have enhanced their project reporting. Building on this momentum, we will continue to push for more DFIs to publish climate finance information and to strengthen the quality and usability of the disclosure already underway.

Hope for the future: examples of progress

Our 2024 examination highlighted the poor transparency of bilateral DFIs in particular (where only total annual climate finance figures were available). Since then some progress has been made. BII now provides disaggregated data in its database showing which projects qualify as climate finance and whether they target mitigation or adaptation. Norfund goes a step further by disclosing climate finance amounts.

However, no bilateral DFI explains how finance is classified as climate-related for individual investments, leaving stakeholders to infer from project descriptions and other limited information.

For MDBs, the Asian Development Bank (AsDB) stands out as an example of better practice in disclosing information currently. It was the only institution to score full points for climate finance transparency in our assessment across both sovereign and non-sovereign portfolios. Highlights include:

- A bulk-downloadable dataset showing each project’s climate finance type and specific amounts for mitigation and adaptation.

- Detailed ‘Climate Change Assessments’ disclosed for sovereign investments, providing rationales and sub-component/activity-level budget breakdowns.

AsDB’s approach sets a minimum standard for other DFIs seeking to improve transparency.

Why transparency matters and how data can be used

Transparent, disaggregated climate finance data is essential for accountability, institutional learning, and alignment with global goals. High-quality disclosure allows:

- Verification of aggregate climate finance figures.

- Assessment of whether investments meet intended mitigation or adaptation objectives.

- Better allocation of resources to areas of greatest need and avoidance of duplication.

The 2025 DFI Transparency Index shows that while progress is being made, there is still a long way to go. Expanding detailed, project-level disclosure is critical for oversight, learning, and evaluating impact. As DFIs scale up climate investments to help meet the global US$300 billion annual target, transparency is the foundation for credibility, accountability, and real climate outcomes. The Index highlights both where DFIs are advancing and where gaps remain, offering a clear roadmap for the disclosure improvements needed to make climate finance fully trackable and effective.

Our next steps

Looking ahead to COP30, a key discussion will be how the new global climate finance target is measured and reported. We are hoping to get stronger commitments on transparency and consistent reporting standards. At the same time, we are continuing our work to make currently available data more accessible and detailed, helping to drive best practices. We have just launched the MDB Climate Finance Dataset, which consolidates current project-level disclosure into a single source. We hope this will be a valuable tool for stakeholders seeking to analyse and track MDB climate finance in detail and to push for further breakthroughs.

Further reading

See the 2025 DFI Transparency Index report for full analysis of the state of DFI transparency.

View our short video with Scott Morris of the Asian Development Bank, talking about their approach to climate finance transparency: