MDB Climate Finance Dataset

Multilateral development banks (MDBs) are central actors in the global effort to scale up climate finance. By 2030, MDBs estimate that their sovereign and non-sovereign portfolios will deliver US$120bn in climate finance each year to low- and middle-income countries. MDBs report headline figures in their Joint Report on Climate Finance (Joint Report): in 2024, they committed US$85.1bn for low- and middle-income economies, compared with US$74.7bn, US$60.9bn and US$50.7bn in 2023, 2022 and 2021 respectively.

At present, behind these headline numbers lies a persistent problem for some MDBs: the lack of systematic, investment-level disclosure. Without complete and accessible project-level data, it is difficult for stakeholders to verify aggregate claims, assess alignment with country priorities, or understand which sectors, regions, and instruments are receiving climate finance. The 2025 DFI Transparency Index highlighted this gap, finding that while several development finance institutions (DFIs), including MDBs, now publish methodologies for counting climate finance, only some disclose consistent project-level data.

The dataset

In January 2026, we released the second version of our MDB Climate Finance Dataset, compiling all publicly available investment-level climate finance from 11 multilateral development banks (MDBs) for the years 2021 to 2024. This updated dataset builds on our November 2025 release. The main purposes of this dataset are to:

- Offer stakeholders a compiled and accessible dataset for data analysis

- Highlight the gaps in MDB reporting

- Offer a benchmark for what meaningful disclosure looks like

- Act as a starting point towards full, standardised disclosure of climate finance at the investment level

The dataset provides the first cross-MDB view of investment-level climate finance disclosure. It examines the climate finance disclosure practices of the eleven MDBs that contribute to the annual Joint Report:

- African Development Bank (AfDB)

- Asian Development Bank (AsDB)

- Asian Infrastructure Investment Bank (AIIB)

- Council of Europe Development Bank (CEB)

- European Bank for Reconstruction and Development (EBRD)

- European Investment Bank (EIB)

- Inter-American Development Bank (IDB)

- IDB Invest

- Islamic Development Bank (IsDB)

- New Development Bank (NDB)

- World Bank Group (WBG) – IBRD/IDA, MIGA and IFC

While we sought data from all eleven institutions, investment-level data was available for only seven MDBs, which we have compiled here.

The file includes two tabs with distinct purposes:

- Source dataset: containing only the information directly disclosed by MDBs in the original sources from which we extracted their project-level data.

- Enriched dataset: a more complete version where we have standardised, edited and, where necessary, supplemented the raw data with information from other MDB sources to fill gaps and improve comparability. This version aims to make the dataset as useful as possible to stakeholders.

Our updated methodology note for the 2021-2024 dataset is available here.

Our full methodology, based on the previous version of the dataset, is available here.

Key findings from 2021-2024 dataset

With the addition of 2024 data, the dataset now covers four years of MDB climate finance (2021-2024). Across this period, we have identified:

- Around 6,500 unique climate finance investments

- $366 billion in climate finance commitments linked to individual projects

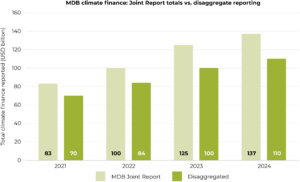

While MDBs report $437 billion in climate finance commitments between 2021 and 2024 through their annual Joint Reports, $71 billion in reported MDB climate finance remains untraceable at the project level across the 2021-2024 period. For the year 2024, we were unable to identify $26 billion of climate finance investments of the $137 billion reported.

Although MDBs report steadily rising climate finance totals, this chart shows that the gap between Joint Report figures and disaggregate data persists across all years.

Key findings include:

- Some institutions (CEB, IDB Invest, IFC, MIGA, IsDB and NDB) still remain entirely absent from the dataset, reporting billions in climate finance each year, yet not allowing those figures to be linked to individual projects.

- Other institutions continue to publish data in formats that limit accessibility. For 2024, only five institutions (AIIB, AsDB, EBRD, EIB, and IDB) publish machine-readable climate finance datasets.

- The World Bank publishes near complete data, but IFC and MIGA remain opaque.

- Evidence from AfDB, AsDB, IDB, EBRD, EIB and AIIB shows that even private sector climate finance can be disclosed without breaching confidentiality.

See more detailed findings in our latest blog post, MDB climate finance in 2024: what does the latest data tell us?

Behind the billions

In November 2025, we released Behind the Billions: tracking the missing pieces of MDB climate finance data, a more detailed analysis accompanying our original 2021-2023 dataset. The report set out how we compiled the dataset, and what we can learn from the data – and the gaps.

Recommendations

Taken together, this body of work demonstrates that while there is growing recognition of the importance of climate finance transparency, there is still no central, publicly available repository of investment-level MDB climate finance data. Our dataset is a start in filling this gap. It begins to show what can be done and what should be done, while also highlighting the gaps that remain. It serves both as a practical tool for users and as an initial benchmark for MDBs, illustrating examples of good practice and areas where disclosure is still insufficient.

The remaining MDBs must move beyond aggregate reporting and publish full, investment-level climate finance data that is both accessible and comprehensive. Without this, stakeholders cannot verify the billions reported in annual totals, nor assess how and where climate finance is being delivered. The disclosure of both sovereign and non-sovereign investment data that matches Joint Report claims by institutions such as IDB and AsDB demonstrates that comprehensive, project-level reporting is feasible. This indicates that barriers to disclosure may be lower than often assumed, and other MDBs should follow this example.